KARACHI:

The Pakistan Stock Exchange (PSX) received a hammer blow in the outgoing week, as the delay in resuming the International Monetary Fund (IMF) lending program dented investor enthusiasm and held them back. ‘difference.

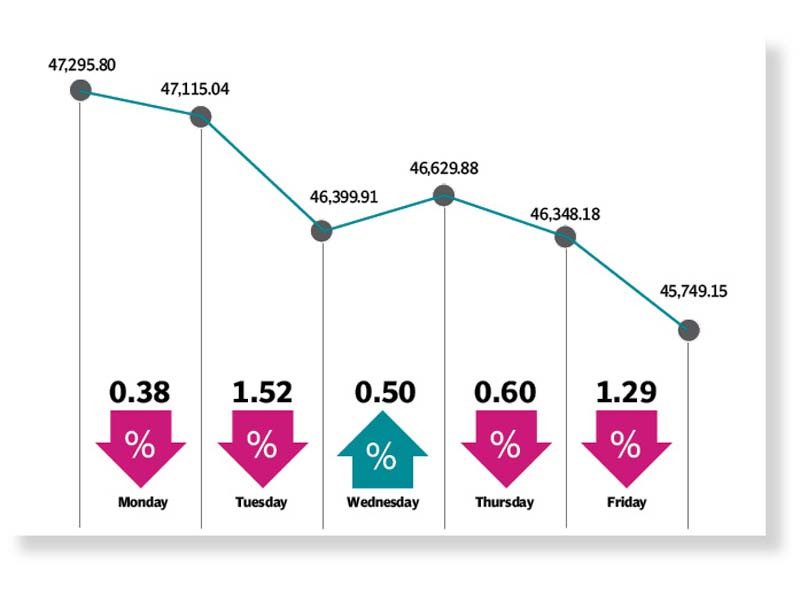

A host of additional negative triggers such as the decline in the value of the rupee against the US dollar and uncertainty over receiving $ 3 billion in cash deposits from Saudi Arabia pushed the index down. KSE-100 benchmark of 1,574 points, or 3.3%, to 45,749 points at the end of the week on November 12.

“Actions during the week showed weakness as market participants appeared frantic amid the delay of positive results from IMF talks on the resumption of the extended $ 6 billion facility for Pakistan,” said a report from Arif Habib Limited.

The KSE-100 index started the week lower and recorded losses in the first two sessions as investors waited in vain for the $ 3 billion cash deposit to the State Bank of Pakistan (SBP) by Riyadh.

Panic over the anticipation of a further rise in petroleum prices and a hike in interest rates by the State Bank as part of the upcoming monetary policy, which will be announced later this month , again weighed on the markets.

In the middle of the week, the market paused and saw a partial rebound amid renewed investor interest following optimistic statements by Prime Minister’s Financial Advisor Shaukat Tarin regarding talks between Pakistan and the IMF.

However, Prime Minister Imran Khan’s appearance before Pakistan’s Supreme Court during a case hearing capped the gains.

The KSE-100 index resumed its downward march in the past two sessions after the surge in US inflation to a 30-year high rocked international markets and triggered a sell off in stocks. Its ripple effect was also felt on the Pakistan Stock Exchange.

Moreover, the lack of progress in talks with the IMF kept investors away.

Morgan Stanley Capital International (MSCI) surprised on Friday by assigning a lower weighting to the PSX in the Frontier Markets index compared to market expectations. This news, in particular, accelerated the liquidation and led to an extension of the bear-run.

Additionally, the rupee plunged to an all-time low of Rs 175.73 in the last session, shaking market participants’ confidence in the economy. Investors expected imported inflation to jump as the local currency continued to weaken against the US dollar.

“We believe that market sentiment depends on the announcement of the IMF package, which is currently blocked by two departments of the fund,†said Arif Habib Limited report. “Once passed, the market is likely to post a rebound.”

Average daily traded volumes plunged 26% on weekdays to 316 million shares while average daily traded value plunged 63% on weekdays to $ 63 million.

At the sector level, the negative contribution was led by banks (-277 points), cement (-255 points), technology (-226 points), exploration-production (-140 points) and engineering (-90 points).

In contrast, the sectors which made a positive contribution were fertilizers (37 points) and glass and ceramics (3 points).

The negative contributors in terms of shares were TRG Pakistan (-140 points), Pakistan Petroleum (-73 points), Oil and Gas Development Company (-70 points), Lucky Cement (-65 points) and UBL (-65 points ).

Meanwhile, the positive contribution came from Fauji Fertilizer (48 points), Engro Fertilizers (17 points) and Allied Bank (9 points).

Foreign sales continued during the week, reaching $ 5.3 million from net sales of $ 11.2 million the week before.

Significant sales were observed in commercial banks ($ 7.6 million) and cement factories ($ 3 million). Locally, the purchases were reported by various companies ($ 6.5 million) followed by insurance companies ($ 5.7 million).

Other big news for the week included foreign exchange reserves exceeding $ 24 billion on official admissions, a reduction in the sales tax on gasoline, a 105% rise in RLNG prices in November and a first quarter. ending with a budget deficit of 0.8% of GDP.

Posted in The Express Tribune, November 14e, 2021.

As Business on Facebook, to follow @TribuneBiz on Twitter to stay informed and join the conversation.

[ad_2]