[ad_1] Analysis of data from MoneySuperMarket shows that while the average amount borrowed decreased by £ 109 in 2019, it increased by £ 793 (7%) in 2020, with the average loan now standing at £ 11,834. In 2019, the average loan size fell in 72% of UK regions, with more than half (53%) seeing a […]

Monthly Archives: October 2020

[ad_1] What are the loan conditions? “Loan terms” refers to the terms and conditions involved when borrowing money. This may include the loan repayment period, the interest rate and fees associated with the loan, penalty fees that may be charged to borrowers, and any other special conditions that may apply. It is important to carefully […]

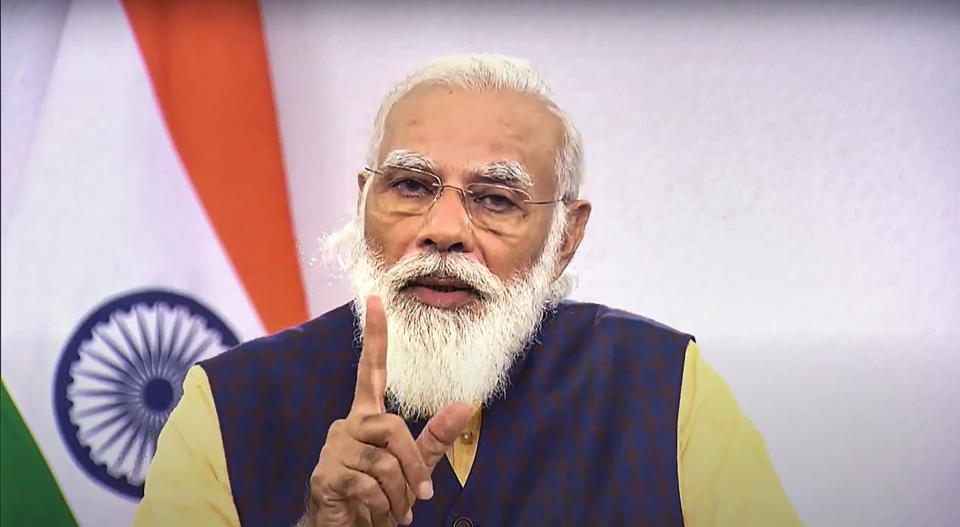

[ad_1] Prime Minister Narendra Modi will virtually distribute loans to nearly 300,000 street vendors on Tuesday under the Pradhan Mantri street vendors Atmanirbhar Nidhi Yojana or PM SVANidhi program. PM Modi will also interact with the beneficiaries. Uttar Pradesh has so far received 557,000 supplier inquiries, the highest across the country. “The program intends to […]

The City of San Mateo, Calif., in partnership with Foster City, secured in its application a $277 million Water Infrastructure Finance and Innovation Act (WIFIA) loan from the ‘US EPA to support the Clean Water program. The clean water program helps repair, replace and upgrade aging sewage and wastewater treatment infrastructure. It serves about 170,000 […]

[ad_1] Pre-approval vs. conditional approval: what’s the difference? With conditional loan approval, an insurer reviews your financial documentation. This is not the case with prior approval. An underwriter is the one who grants or denies your loan, so an underwriter’s conditional loan approval carries more weight than a pre-approval letter. Pre-approval and conditional approval are […]

[ad_1] If your bad credit is preventing you from getting a car loan, it’s time to look at other options and the next possible step. There are things you can do to improve your chances of getting your next car loan. Auto loans and your credit score Traditional auto lenders, such as banks, credit unions, […]

Before the onslaught of Covid-19, when the markets were afloat, lenders gave up asking for protections in their loans. Now, there are signs that the situation is getting even worse, according to PitchBook’s third quarter report on private equity markets. Some recent transactions contain unusual terms or conditions that allow loans to be transferred to […]

[ad_1] NEW YORK, October 06, 2020 (GLOBE NEWSWIRE) – Small business loan approval percentages at big banks ($ 10 billion and more in assets) fell slightly from 13.6% in August to 13.5% in September, indicative of the difficulties facing small businesses, according to the latest Biz2Credit Index of Small Business Loansâ„¢ released today. the Biz2Credit […]

[ad_1] October 2, 2020 BY MELISHA YAFOI The National Development Bank will publish its official terms and conditions for its new loan products under the financing of SMEs of K80 million. According to NDB, the four new products introduced by the bank to help SMEs came as a result of the dialogue the bank had […]